Teaching Kids About Money: Why Hiding Your Expenses Makes Them Think You're Rich

Learn how family budget transparency teaches teens real financial literacy. Discover why showing your kids family expenses builds money management skills better than lectures ever could.

Zedger Team

Teaching Kids About Money: Why Hiding Your Expenses Makes Them Think You're Rich

The "Just Use Your Card" Problem

Picture this: You're at the checkout counter. Your 14-year-old casually tosses a $60 hoodie into the cart.

"Whoa, put that back. We're not getting that today."

"Why not? Just use your card."

"It's not in the budget."

"But you literally bought groceries with your card five minutes ago. Just... use it again?"

If you've had this conversation—or some version of it—you're dealing with what I call the Invisible Money Problem.

Our kids genuinely believe we have unlimited money because they never see us run out. We tap our phones to pay. We click buttons to order. We swipe cards without blinking. From their perspective, money isn't real—it's just... always there.

And here's the uncomfortable truth: We created this problem by keeping them in the dark.

Not because we're bad parents. Not because we're trying to spoil them. But because somewhere along the way, we decided that "kids shouldn't worry about money" meant "kids shouldn't know anything about money."

Those are not the same thing.

The Financial Literacy Crisis Nobody's Talking About

Here's a stat that should terrify every parent: Most teenagers can't read a bank statement. They don't understand what a budget is. They think credit cards are free money that you "pay back whenever."

And why would they think differently? We've never shown them how money actually works.

We say things like:

- "Money doesn't grow on trees" (meaningless)

- "Do you think I'm made of money?" (confusing)

- "We can't afford that" (while buying other things, so clearly we can afford stuff)

From their perspective, our financial decisions look completely arbitrary. Random. Unfair.

The real lesson they're learning? Money is a mysterious adult thing that makes no sense.

And then we're shocked when they go to college, max out a credit card in their first semester, and call us crying about debt.

What Teens Think vs Reality

| What Teens Think | The Reality |

|---|---|

| Credit cards are free money | Credit cards are loans with 20%+ interest |

| Parents have unlimited money | Every dollar has already been allocated |

| ATMs give out free cash | ATMs dispense money you already earned |

| You can always just buy more | Every purchase means saying no to something else |

Why "The Talk" Needs to Include Your Family Budget

We're comfortable having "the talk" about a lot of things. Drugs. Social media. Driving safely. Relationships.

But money? That's somehow off-limits.

We treat our family finances like classified information. Our kids have no idea:

- What rent or mortgage actually costs

- How much groceries are for a family

- What utility bills run each month

- How much is left over after all the bills are paid

And then we wonder why they don't understand why we can't just "buy whatever."

Here's the radical shift that changes everything: Show them the budget.

Not because you want them stressed about bills. Not because you're trying to make them feel guilty. But because financial literacy for kids starts with understanding that money is finite and choices have to be made.

The Strategy That Actually Works

Instead of vague warnings and mysterious "no's," try this:

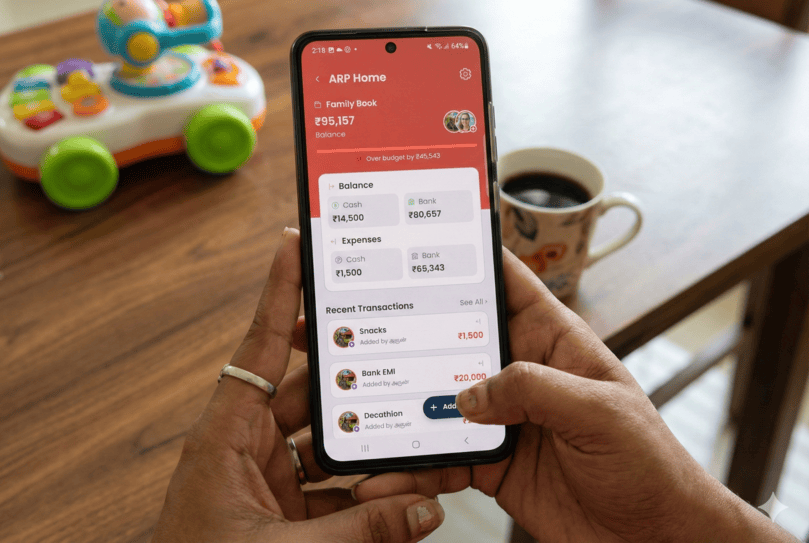

Pull out your phone, open your family expense tracker, and show them reality.

"Look at this month. See this number? That's what we spent on groceries. This one is electricity. This is the car payment. This is insurance. And this little amount at the end? That's what we have left for everything else—eating out, entertainment, new clothes, all of it."

Watch their face change as it clicks.

"Wait... so when I asked for those $150 shoes last week..."

"Yep. That would have been half of our 'everything else' money for the entire month."

From "Bad Guy Who Says No" to "Partner Who Explains Reality"

This subtle shift is massive.

You're no longer the villain who arbitrarily denies them things. You're the partner who's showing them the constraints everyone operates under.

Before (The Old Way):

Teen: "Can I get new AirPods?" Parent: "No, that's too expensive." Teen: "You never let me have anything!" [slams door]

After (The Transparent Way):

Teen: "Can I get new AirPods?" Parent: "Let's check the budget together. [opens Zedger] We've got $200 left for the month after bills. AirPods are $180. That means if you get them, we have $20 left for everything else for two weeks. No eating out, no spontaneous Target runs, nothing. Your call—what do you think we should do?" Teen: "Oh... maybe I'll wait until next month."

See the difference?

In the first scenario, you're the enemy. In the second, you're teaching critical thinking and trade-offs.

Age-Appropriate Money Transparency: What to Share When

You don't need to share everything with every age. But you should share something with everyone old enough to ask "why can't we afford it?"

Elementary School (Ages 5-10): The Foundation Years

What to share: Basic concepts in simple terms.

"We have money for fun things, but we have to pay for boring things first—like keeping the lights on and food in the fridge. If we spend too much on boring things, we have less for fun things."

What NOT to share: Your actual income, debt details, or financial stress.

Why it matters: They're forming their baseline understanding that money is limited. That's it. Keep it simple.

Middle School (Ages 11-13): The Curiosity Years

What to share: Category-level spending without specific dollar amounts.

"This month, groceries cost more than usual because we had that big birthday party. So we're eating at home more to balance it out."

What NOT to share: Adult financial anxiety, relationship tensions about money, or complicated details about investments/debt.

Why it matters: They're starting to connect cause and effect. "If we spend here, we can't spend there" is a concept they can grasp now.

High School (Ages 14-18): The Real-World Preparation Years

This is where you go all-in on transparency.

What to share: Actual numbers, real trade-offs, and the full family expense picture.

Give them access to your family expense tracker. Let them see:

- What things actually cost

- How quickly small expenses add up

- What "necessary" vs "discretionary" spending looks like

- How you make decisions when you can't afford everything you want

Why it matters: In 1-4 years, they'll be making these exact decisions on their own. Better they learn now with your guidance than later through painful mistakes.

The Power of Giving Them Access

Here's where a family expense tracker app like Zedger becomes incredibly valuable.

Instead of you being the gatekeeper of all financial information, give your teen their own login to the family expense group.

Suddenly:

- They can check spending anytime without asking you

- They see the real numbers, not your filtered version

- They start asking better questions: "Why is our grocery bill so high this month?" instead of "Why can't I have this?"

- They begin to understand money as a tool with limits, not as an infinite resource

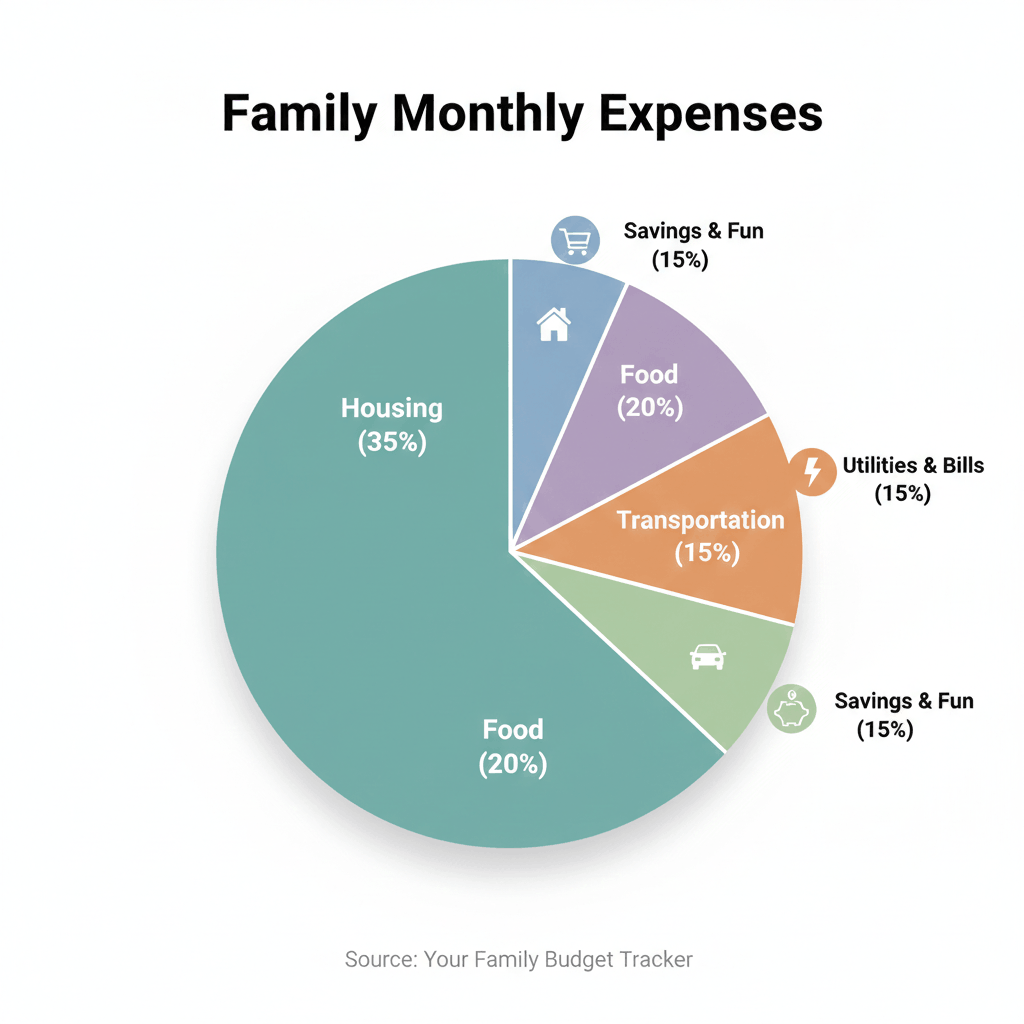

Teaching Through Real Expenses: The Monthly Breakdown Conversation

One of the most powerful teaching moments is the monthly budget review. This doesn't have to be formal or scary—it can be a 10-minute conversation over dinner.

The Setup: "Hey, let's look at this month's expenses together. I want to show you something interesting."

Pull up your family expense tracker (Zedger) and walk through it:

The Fixed Expenses (The Non-Negotiables)

"These are the things we have to pay no matter what:

- Rent/Mortgage: $X

- Utilities: $X

- Insurance: $X

- Car payment: $X

Total: $X

This money is gone before we even think about anything else."

The Variable Expenses (Where Choices Happen)

"These are the things we control:

- Groceries: $X

- Eating out: $X

- Entertainment: $X

- Gas: $X

- Shopping: $X"

The Teaching Moment

"Notice how our 'eating out' category is almost as much as our electricity bill? That's interesting, right? We could cut that in half and barely notice—or we keep it because we value family dinners out together. But we can't do that AND buy new furniture this month. We have to choose."

This is financial literacy in action.

Not lectures. Not scare tactics. Just reality, presented clearly.

The Grocery Store Teaching Moment

Want to see financial literacy click in real-time? Take your teen grocery shopping and show them the expense tracker.

Before shopping: "Our grocery budget this month is $600. We've spent $480 so far. That means we have $120 left for this trip and the rest of the month."

During shopping: Let them add up items as you go. Show them the running total in your cart.

The revelation: "We're at $95 already and we haven't even gotten to the meat section yet. This is why I buy store brand sometimes instead of name brand. Not because we're broke—because I'm choosing to spend money on other things that matter more to me."

After shopping: Log the expense in Zedger together. Show them how the category updates.

"See? Now we have $25 left for groceries this month. We'll probably need milk and bread before the month ends, so we need to be strategic."

This isn't about making them anxious. It's about making the invisible visible.

Money Management Skills for Teens: The Practice Budget

Once your teen understands how the family budget works, it's time to give them their own.

The Setup: Choose one category of spending that will now be their responsibility. Common options:

- Their clothing budget

- Their entertainment/social budget

- Their phone bill

- Their gas money (if they drive)

The Amount: Give them a monthly amount—let's say $100 for clothing.

The Rules:

- They manage it completely

- When it's gone, it's gone until next month

- They can save unused amounts for bigger purchases

- They track it themselves in the family Zedger group

The Learning:

- Month 1: They probably blow it all in week 1 on something impulsive.

- Month 2: They start planning a little.

- Month 3: They're checking prices, comparing options, and maybe even saving some.

- Month 6: They're making smarter decisions than some adults you know.

This is how you create financially capable adults.

The "Spending Accountability" Conversation (Without the Lecture)

Here's a conversation style that works way better than lectures:

Instead of: "You spend too much money on coffee! That's $5 every day! Do you know that's $150 a month?!"

Try this: "I noticed in our expenses that coffee shops are coming up a lot. Want to look at the numbers together? [Opens Zedger] Looks like about $140 this month. No judgment—I spend that much on my hobby too. But I'm curious: is that something you're consciously choosing, or is it just kind of happening?"

Teen: "I... didn't realize it was that much."

You: "Yeah, small daily expenses are sneaky like that. The question isn't whether it's too much—it's whether it's worth that much to you. Because that money could also be going toward [thing they're saving for]. Your call."

The difference?

- You're not shaming them

- You're using data, not emotions

- You're treating them like a partner, not a child

- You're teaching them to audit their own spending

This is the kind of conversation they'll remember when they're 25 and wondering where their paycheck went.

What Makes Zedger Different for Family Financial Transparency

Look, there are a million budgeting apps out there. Most of them are designed for adult couples or individuals trying to manage their own money.

Zedger is different because it's built around groups sharing expenses.

For families, this is perfect because:

1. Everyone Gets Their Own Access

Your teen downloads Zedger, joins your family group, and can see expenses in real-time. No more asking you for updates—they can check themselves.

2. It's Transparent by Default

When you log "Groceries - $127," everyone in the family group sees it. No secrets, no mystery. Just reality.

3. It Shows Who Paid What

Your teen can see that you're covering the mortgage, utilities, groceries—all the invisible expenses they didn't know existed. This builds appreciation and understanding.

4. It's Not a "Spy App"

Unlike some parental control financial apps, Zedger isn't about monitoring every penny your teen spends. It's about shared visibility into family finances. You're including them in the conversation, not watching them from the shadows.

5. It Scales with Independence

Start by just showing them family expenses. As they get older, they can start adding their own expenses. By the time they move out, they already know how to track spending because they've been doing it with you. You can even organize expenses into separate books for different categories—one for household bills, another for teen spending money.

The "But What If They Worry?" Concern

The #1 pushback I hear from parents about financial transparency:

"I don't want my kids to stress about money. That's my job as a parent—to protect them from that worry."

I get it. I really do.

But here's the thing: There's a massive difference between financial anxiety and financial literacy.

Financial Anxiety:

- "We might lose the house"

- "I don't know how we'll pay this bill"

- Visible parental stress and fear

- Discussions about serious financial hardship

You should NOT share this with young kids. This creates trauma, not learning.

Financial Literacy:

- "This is what things cost"

- "This is how we make choices"

- "We have enough, but we have to prioritize"

- Matter-of-fact discussions about trade-offs

You SHOULD share this, even with younger kids. This creates competence, not fear.

The Litmus Test:

If your financial situation is stable enough that you're not in crisis, then showing your kids the budget isn't creating stress—it's creating awareness.

If you ARE in crisis (job loss, major medical bills, housing insecurity), then yes—protect young kids from those details while still teaching basic money concepts.

But for most families? You're not protecting them by hiding the budget. You're just keeping them ignorant.

Real-World Scenarios Where Transparency Changes Everything

Scenario 1: The "Everyone Else Has It" Argument

Without transparency: Teen: "Everyone at school has the new iPhone!" Parent: "Well, we can't afford it." Teen: "That's not fair!" [feels singled out and resentful]

With transparency: Teen: "Everyone at school has the new iPhone!" Parent: "Let's look at the budget. The new iPhone is $1,000. Our monthly 'extra' money after bills is $400. If we buy that phone, we're wiping out 2.5 months of flexibility. No eating out, no emergency fund addition, no nothing. Plus we'd have to increase the phone bill by $30/month. Want to do the math on what that means for the year?" Teen: [Actually thinks about it] "That's... actually a lot."

Scenario 2: The Impulse Purchase They Regret

Without transparency: Teen buys $80 worth of Sephora makeup with birthday money. Uses it twice. Forgets it exists. No lesson learned.

With transparency: Teen buys $80 of makeup, logs it in Zedger (because you've taught them to track their own spending). Two weeks later, needs money for a concert ticket. Opens Zedger, sees the makeup purchase. [The regret is immediate and educational]

"Ugh, if I hadn't bought all that makeup I never use, I could afford this ticket."

You don't even have to say "I told you so." The data does the teaching.

Scenario 3: The Family Vacation Decision

Without transparency: Parent: "We're not taking a big vacation this year." Teen: "Why not? My friend's family is going to Hawaii!" Parent: "Because I said so." Teen: [Resentful, doesn't understand]

With transparency: Parent: "Let's talk about vacation budget. We have $3,000 we could spend. A Hawaii trip for our family would be about $8,000. We could do it if we put it on a credit card, but then we'd be paying interest for the next year, which means less money for everything else. OR we could do a road trip to [state park] for $1,200, have an awesome time, and still have $1,800 left over for emergencies or other fun stuff. What sounds better to you?"

Teen: [Feels included in decision] "Honestly, the road trip sounds fun. And I want a car next year, so maybe we should save some of that money?"

See how transparency turns conflict into collaboration?

The Long Game: What Financial Transparency Teaches Beyond Money

When you show your kids the family budget and include them in financial discussions, you're teaching way more than just money management skills.

You're teaching:

- Critical Thinking — "If this, then what? If we spend here, what can't we spend there?"

- Delayed Gratification — "I want this now, but if I wait, I can get something better later."

- Opportunity Cost — "Choosing this means not choosing that."

- Data-Driven Decision Making — "Let's look at the numbers before we decide."

- Emotional Regulation Around Money — "Money decisions aren't about feelings; they're about math and priorities."

- Empathy and Appreciation — "Oh wow, I had no idea keeping this house running cost that much. No wonder mom's always stressed about the thermostat."

These are life skills that will serve them in every area of life, not just finances.

Common Mistakes Parents Make (And How to Avoid Them)

Mistake #1: Waiting Until They're 18

By 18, they're already making financial decisions—often terrible ones. Start the transparency conversations by age 13, at the latest.

Mistake #2: Making It a One-Time "Money Talk"

This isn't sex ed. You can't have one awkward conversation and be done. Make it ongoing—monthly budget reviews, grocery store discussions, casual mentions of trade-offs.

Mistake #3: Using Money as Punishment or Reward for Behavior

"You got a B on your test? No allowance this week!" This teaches them that money is a tool for control, not a tool for life. Keep money lessons separate from discipline.

Mistake #4: Hiding Your Own Money Mistakes

If you overspent this month, say so. "I went over budget on takeout this month because I was exhausted from work. Now I'm paying for it by having to cut back on other things. Lesson learned—I need to meal prep better."

Your mistakes are teaching opportunities.

Mistake #5: Giving Them Access Without Context

Just adding them to Zedger without explaining what they're looking at is overwhelming. Walk them through it first. "This is what each category means. This is why we track this. Here's what to pay attention to."

Getting Started: The 30-Day Family Financial Transparency Challenge

Want to try this but don't know where to start? Here's a simple 30-day plan.

Week 1: The Introduction

- Set up Zedger with your family expenses

- Add your teen to the family group

- Have a 15-minute "budget overview" conversation: "This is what things cost, this is how we decide what to spend money on"

Week 2: The Real-Time Tracking

- Log every expense for the week in Zedger

- At dinner one night, show them the week's spending: "Look at this—we spent $200 on groceries and $150 on eating out. That's almost the same!"

- Ask: "Does that surprise you? Would you change anything?"

Week 3: The Practice Budget

- Give them one category to manage (their clothing budget, entertainment money, etc.)

- Let them track it themselves in Zedger

- Check in mid-week: "How's your budget looking?"

Week 4: The Monthly Review

- Sit down together and review the whole month

- Ask: "What did you learn? What surprised you? What would you change?"

- Set one financial goal together for next month

That's it. Four weeks. Simple, structured, and actually doable.

The Bottom Line: Stop Protecting Them from Reality

Here's the hard truth that every parent needs to hear:

Hiding your family finances from your kids doesn't protect them. It cripples them.

You're not shielding them from stress—you're keeping them ignorant.

And ignorance about money is not bliss. It's expensive. It's painful. And it can ruin lives.

The young adults who thrive financially aren't the ones whose parents were wealthy. They're the ones whose parents were transparent.

They knew what things cost. They understood trade-offs. They watched their parents make tough choices and explain the reasoning. They learned that money is a tool, not magic.

Your Teen Needs to Know:

- What it costs to keep the lights on

- Why you sometimes say "not right now"

- How you make decisions when you can't afford everything

- That financial security isn't about having unlimited money—it's about managing limited money well

And They Need to Learn It From You

Because if they don't learn it at home, they'll learn it the hard way:

- With a maxed-out credit card at 19

- With an eviction notice at 22

- With crushing student loan debt at 25

- By calling you in tears, asking "Why didn't anyone teach me this?"

You have a choice right now.

Keep the budget hidden, keep the decisions mysterious, keep the money talk taboo.

Or pull out your phone, open Zedger, and say:

"Hey, come here. I want to show you something important."

Start the Conversation Today

Financial transparency doesn't require a complete life overhaul. It doesn't require you to be debt-free or have your financial life perfectly together.

It just requires honesty, consistency, and a willingness to include your teen in the conversation.

Here's how to start right now:

- Download Zedger — Set up your family expense tracking in less than 5 minutes

- Add your teen to the family group — Give them their own access to see real expenses

- Have the first conversation — "I'm going to start showing you what things actually cost because I want you to understand how money works in real life"

- Log expenses for one week — Just track what you normally spend

- Review it together — "Here's what this week looked like. What surprises you?"

That's it. You've started.

From there, it's just consistency. Monthly reviews. Quick conversations. Real-time transparency.

And in a few years, when your kid moves out and actually knows how to budget, how to make trade-offs, and how to manage money without panicking?

You'll be glad you had the courage to show them the numbers.

Download Zedger and Start Teaching Financial Literacy Today

Give your family the transparency tool that makes money visible and teaches real-world budgeting skills.

Get Started with ZedgerBecause the goal isn't to raise kids who never make money mistakes.

It's to raise adults who know how to recover from them.

And that education starts with transparency—right now, while they're still under your roof.

Related Articles

Tags: