How to Create a Family Budget That Actually Works (Without the Stress)

Stop the budget burnout cycle. Learn how to create a family budget plan that survives real life using the 50/30/20 rule or zero-based budgeting.

Arun Andiselvam

How to Create a Family Budget That Actually Works (Without the Stress)

Introduction: The "Budget Burnout" Cycle

You know the drill. January rolls around, and you're pumped. This is the year you finally get your family's finances under control. You download a spreadsheet, color-code your expenses, and announce to your partner: "We're doing this!"

Week one? Flawless. Week two? Still good. Then someone's car breaks down. Or your kid needs new soccer cleats. Or you forget it's your anniversary and end up at that restaurant you definitely didn't budget for.

Suddenly, the whole thing falls apart. The spreadsheet gets abandoned. The guilt creeps in. And you think, "Maybe we're just bad with money."

Here's the truth: You're not bad with money. Your budget was bad for your life. What you need is a smarter approach — and the right tools, like Zedger, to back it up.

This isn't about turning into the family that never orders pizza or bans Target runs. It's about telling your money where to go before it disappears, so you're not lying awake at 2 AM wondering how the checking account is already empty again.

By the end of this guide, you'll have a family budget that bends without breaking—one that survives the chaos of real life and actually helps you reach the goals that matter, whether that's a vacation, paying off debt, or just not panicking every time you check your bank balance.

Step 1: The Financial Audit (Scary, but Necessary)

Let's rip off the Band-Aid. Before you can build a budget, you need to know where you actually stand. Not where you think you stand. Where you actually stand.

Start here:

Grab your last three months of bank and credit card statements. Yes, all of them. Print them out if you need to—there's something about seeing paper that makes the numbers hit differently.

Now calculate your total household income. That's the money that actually hits your account after taxes, insurance, and retirement contributions. Not your salary on paper. The real, take-home number.

Next, list every fixed expense. These are the ones that don't budge month to month:

- Mortgage or rent (splitting with roommates? Check out the best roommate expense tracker apps)

- Car payments

- Insurance (home, auto, health)

- Minimum debt payments

- Utilities (even though they fluctuate slightly — if you're splitting bills with roommates, make sure everyone's share is tracked)

- Childcare or tuition

Then comes the uncomfortable part. Go through those three months of statements and highlight everything else. The Target run that was supposed to be $40 but ended up at $127. The food delivery on that Tuesday you were too tired to cook. The streaming services you forgot you were even paying for.

You're not doing this to shame yourself. You're doing it to see the truth. Because that $12.99 Disney+ subscription and that $9.99 iCloud storage and that $14.99 music subscription? They're small. But when you find eight of them, that's $350 a year that could've gone toward something you actually care about.

Pro tip: Look for the "zombie subscriptions"—the free trials that turned into paid memberships you never use. Gym memberships where you haven't gone since March. Magazine subscriptions your kids signed you up for.

This audit isn't fun. But it's the foundation. You can't plan where you're going if you don't know where you've been.

![]()

Step 2: Choose Your Weapon: 50/30/20 vs. Zero-Based

Here's where people get tripped up. They think there's one "right" way to budget, and if it doesn't work for them, they're doing something wrong.

The truth? Budgeting is like parenting. What works for your neighbor's family might be a disaster for yours.

Let's break down the two most popular methods so you can pick your fighter.

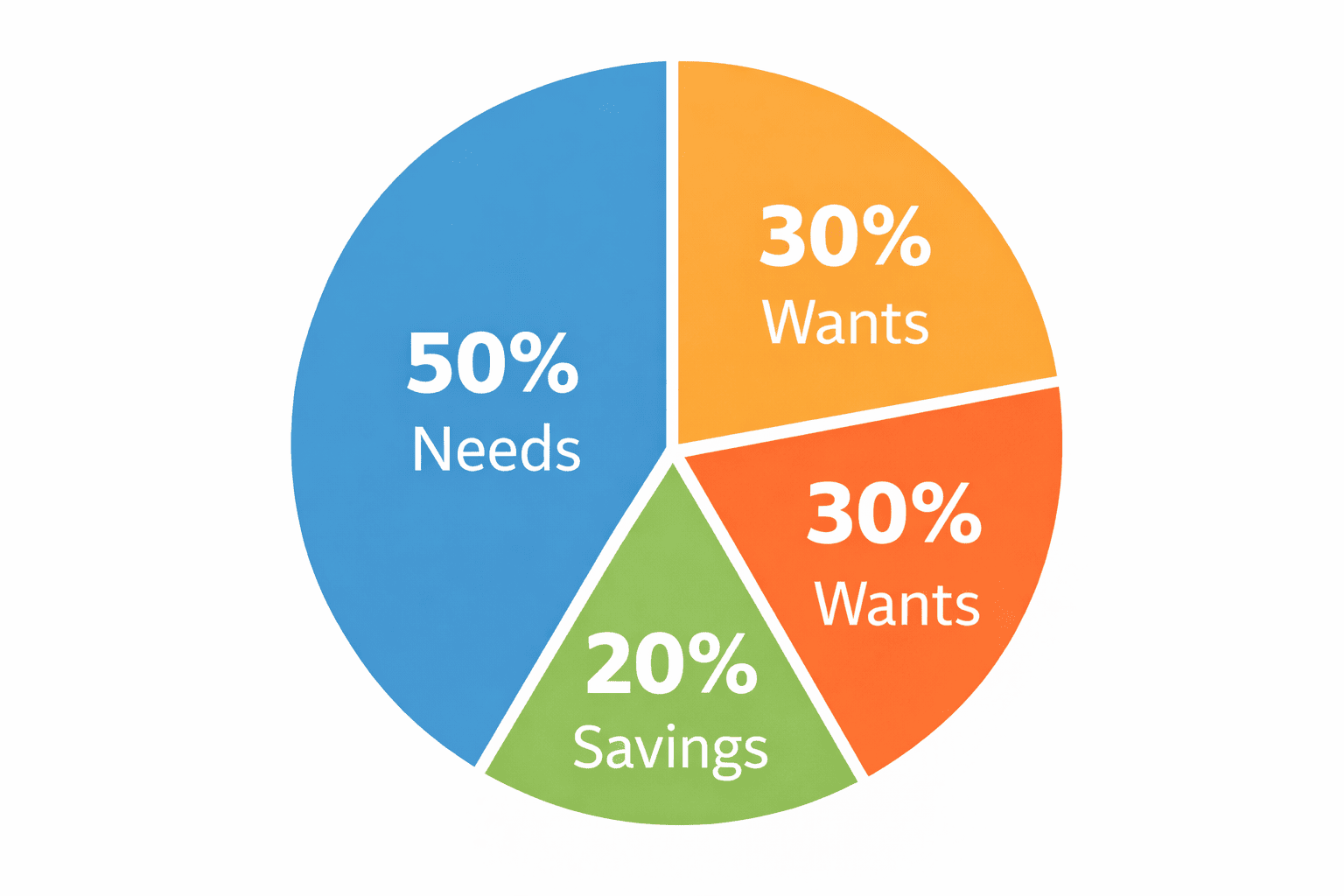

The 50/30/20 Rule (Best for Consistency)

This is the budget method for people who want structure but not a straitjacket.

Here's how it works:

- 50% of your income goes to Needs (mortgage, utilities, groceries, insurance, minimum debt payments)

- 30% goes to Wants (dining out, hobbies, streaming services, the stuff that makes life enjoyable)

- 20% goes to Savings and Debt Payoff (emergency fund, retirement, paying extra on loans)

Why families love it:

It's forgiving. You're not tracking every single dollar. As long as you're in the ballpark of those percentages, you're good. It gives you breathing room.

That 30% "Wants" category? That's your guilt-free spending. You don't have to justify the takeout or the new jeans. It's built into the plan. And honestly, that alone might save your marriage more than any couples therapy.

When it works best: If your income is steady and predictable. If you're not drowning in debt. If you want a system that doesn't require updating a spreadsheet every time someone buys gas.

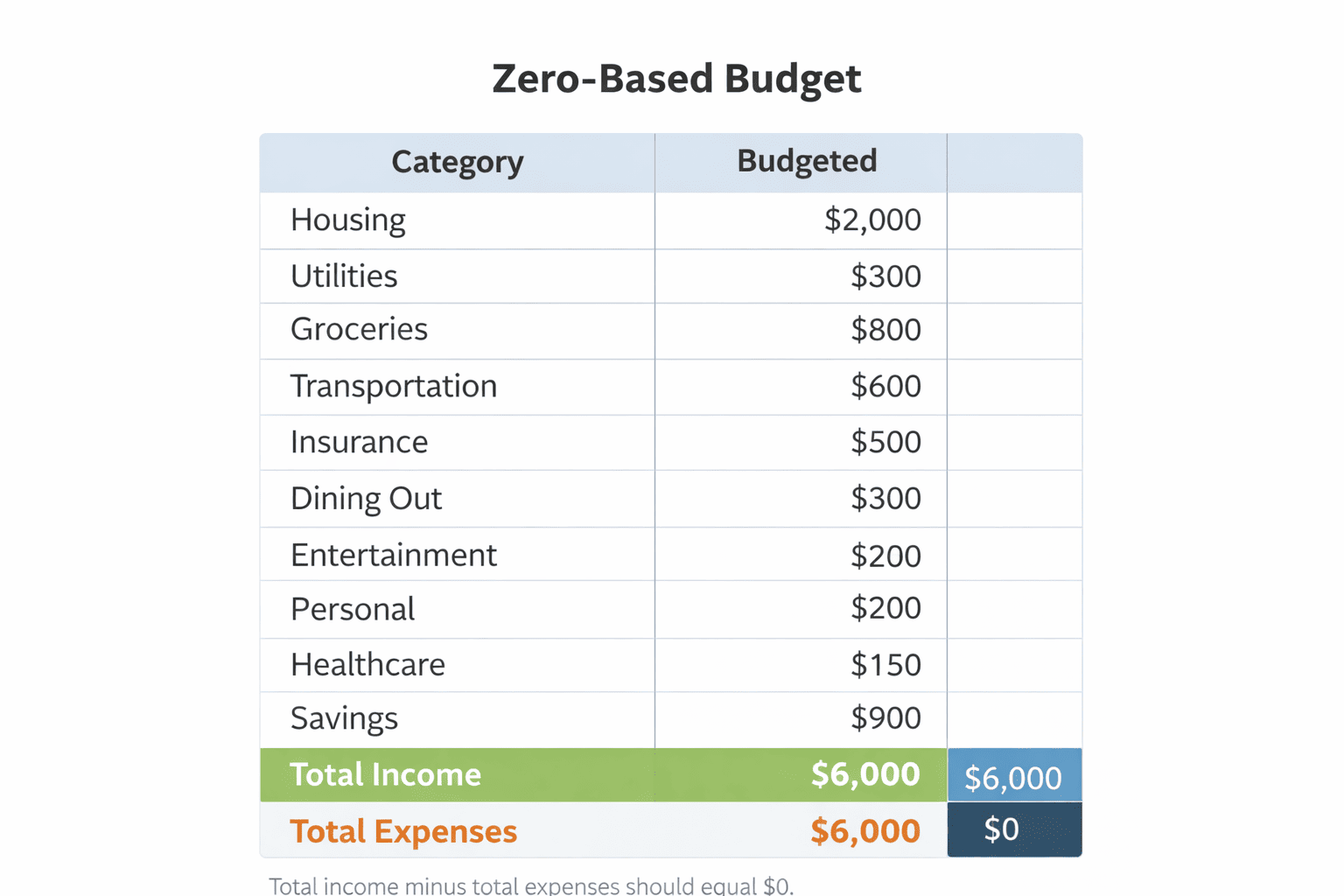

Zero-Based Budgeting (Best for "Every Dollar Counts")

This is for the detail-oriented folks. The ones who get a weird satisfaction from balancing their checkbook to the penny.

Here's the concept: Income minus Expenses = $0.

Every single dollar you earn gets assigned a job before the month starts. Rent gets $1,200. Groceries get $600. Date night gets $80. Emergency fund gets $200. Even if a dollar's job is "sit in savings," it still has a job.

At the end of the month, your budget should show zero dollars unassigned. Not zero dollars in your account—zero dollars without a purpose.

Why families love it:

Total control. You know exactly where every penny is going. There's no "mystery" about why the account is low.

This method is incredible if you're paying off debt aggressively or if your income varies wildly (freelancers, commission-based jobs, seasonal work). Because when you know a slow month is coming, you can plan for it instead of panicking.

When it works best: If you have irregular income. If you're laser-focused on getting out of debt. If you genuinely enjoy tracking your money. If the phrase "every dollar has a name" makes you feel weirdly excited instead of exhausted.

The catch? It takes time. You'll spend an hour at the beginning of each month planning. And if you hate spreadsheets, this might feel like homework.

Step 3: The "Family Meeting" (How to Talk About It)

Alright, you've done the audit. You've picked your method. Now comes the part most people dread: getting everyone on the same page.

Because here's the thing—budgets fail when one person is trying to stick to it and the other person is still impulse-buying plants at Home Depot.

Don't make this a lecture. Make it a pizza night.

Seriously. Order food, sit down when the kids are occupied (or asleep, if they're little), and frame this as a team strategy session, not a financial intervention.

Start with the "why."

Don't lead with "We're spending too much." Lead with "What do we want this year to look like?"

Maybe it's finally taking that beach trip you've been talking about for three years. Maybe it's paying off the credit cards so you stop throwing money at interest. Maybe it's just having enough in the bank that you don't fight every time an unexpected bill shows up.

When you connect the budget to something you want, it stops feeling like deprivation and starts feeling like a plan.

Involve the Kids

Yes, even the kids.

You don't need to show them your salary or scare them about money. But you can teach them about trade-offs.

"Hey, we're cooking at home more this month so we can save up for that waterpark trip this summer. Want to help pick the meals?"

Or: "We're cutting back on buying toys right now because we're saving for the new trampoline in the backyard."

Kids are smarter than we give them credit for. And when they understand the why, they're less likely to meltdown at Target because you said no to the $40 LEGO set.

Set a "Mad Money" Allowance

Here's the secret weapon for couples: Give each partner a "no questions asked" allowance.

Maybe it's $50 a month. Maybe it's $150. Whatever fits your budget. But this is money each person can spend on whatever they want without justifying it.

Your partner wants to blow it on fantasy football? Fine. You want to spend it on candles that smell like "autumn leaves and nostalgia"? Also fine.

This tiny buffer prevents the resentment that kills budgets. Because when every single purchase requires a debate, someone's going to snap and buy something out of spite. (Don't pretend you don't know what I'm talking about.)

Step 4: The Execution (Where Most People Fail)

Okay, you've got your budget. You've had the meeting. Everyone's on board.

Now what?

This is where the rubber meets the road—and where most people crash and burn. Not because they're bad at math. But because life happens fast, and if your system requires constant manual effort, it's not going to survive.

Automate Everything

If you're still manually paying bills every month, stop. Right now.

Set up autopay for everything that doesn't change: mortgage, car payment, insurance, phone bill, internet. Schedule automatic transfers to savings on payday, before you have a chance to spend it.

Why? Because willpower is a limited resource. You're not going to "remember" to transfer money to savings after you've already spent three hours helping with homework, making dinner, and breaking up a fight over the iPad.

Automation removes the decision. The money moves before you can think about it.

The "Oops" Fund

Here's what the budgeting gurus don't tell you: Your budget will get wrecked. Repeatedly.

The school announces a field trip that costs $45. Your car needs new tires three months earlier than expected. Your kid outgrows their cleats in what feels like two weeks.

If you don't plan for this, every unexpected expense feels like a failure. And after enough "failures," you quit.

Solution: Build in a buffer category.

Call it "Oops," "Life Happens," "Miscellaneous," or "Chaos Fund"—whatever makes you feel better. Even if it's just $100 a month, that cushion means the budget bends instead of breaks when life throws a curveball.

And trust me, life will throw curveballs.

Tracking (Without Losing Your Mind)

Here's the thing about tracking expenses: if it's annoying, you won't do it.

Saving receipts in a shoebox? You'll quit in two weeks. Manually typing every purchase into a spreadsheet? Same.

You need a system that runs in the background of your life, not one that requires a nightly homework session.

Using a family expense tracker app (like Zedger) means you can log purchases in two seconds while you're still in the parking lot. Take a photo of the receipt, categorize it, done. Or better yet, explore Zedger's features — like auto-categorization and smart splitting — to make tracking effortless.

When tracking is easy, you actually do it. And when you can organize expenses into separate books — groceries in one, subscriptions in another — you get a clear picture of where your money is going and make better decisions before you blow the grocery budget on a cart full of snacks you didn't need.

![]()

Step 5: Review and Tweak

Real talk: Your first budget will be wrong.

You'll underestimate groceries. You'll forget about car registration. You'll realize you allocated $50 for "entertainment" when your family's idea of entertainment costs $150.

This is normal. Budgeting isn't about perfection on the first try. It's about learning what your life actually costs.

At the end of the first month, sit down (pizza night, round two) and review. Ask:

- What categories were we way off on?

- What expenses did we totally forget about?

- Where did we feel deprived? Where did we feel like we had too much?

Then adjust. Maybe you need more in groceries and less in clothing. Maybe you overestimated how much you'd spend on gas now that you're working from home.

Give yourself three months to dial it in. By month three, your budget should feel less like a restriction and more like a roadmap.

And here's the best part: Once you've got it dialed in, you don't have to think about it as much. It just... works. Bills get paid. Savings grow. You can buy the birthday present without guilt because the money's already set aside.

Conclusion

The best budget isn't the one that looks perfect on paper. It's the one you actually stick to.

It's the one that survives the birthday parties, the broken appliances, the forgotten school fees, and the occasional "we deserve takeout tonight" moment.

It's the one that doesn't make you feel like a failure every time you spend money, but instead gives you permission to spend because you planned for it.

You don't need to be a financial expert. You don't need a degree in accounting. You just need a system that fits your life — and one that's affordable — not someone else's idea of what your life should look like.

So here's your challenge: Start with Step 1. Pull those bank statements. See where you really are. Then pick a method and give it a real shot—three full months, no quitting allowed.

Ready to build a budget that adapts to your family's real life?

Try Zedger today — the expense tracker designed for families who are tired of spreadsheets and ready for a system that actually works.

Get Started with ZedgerRelated Articles

Tags: